Green Finance Impact Reporting Tool

Impact performance monitoring of assets or entities financed with green or sustainability-linked bonds and loans.

Introducing the Green Finance Impact Reporting Tool

The tool helps investors and stakeholders more efficiently calculate and report on the impact of assets, projects or entities financed with green or sustainability-linked bonds and loans, versus their stated ESG performance metrics.

Green Finance Impact Reporting Tool Explained

What is it?

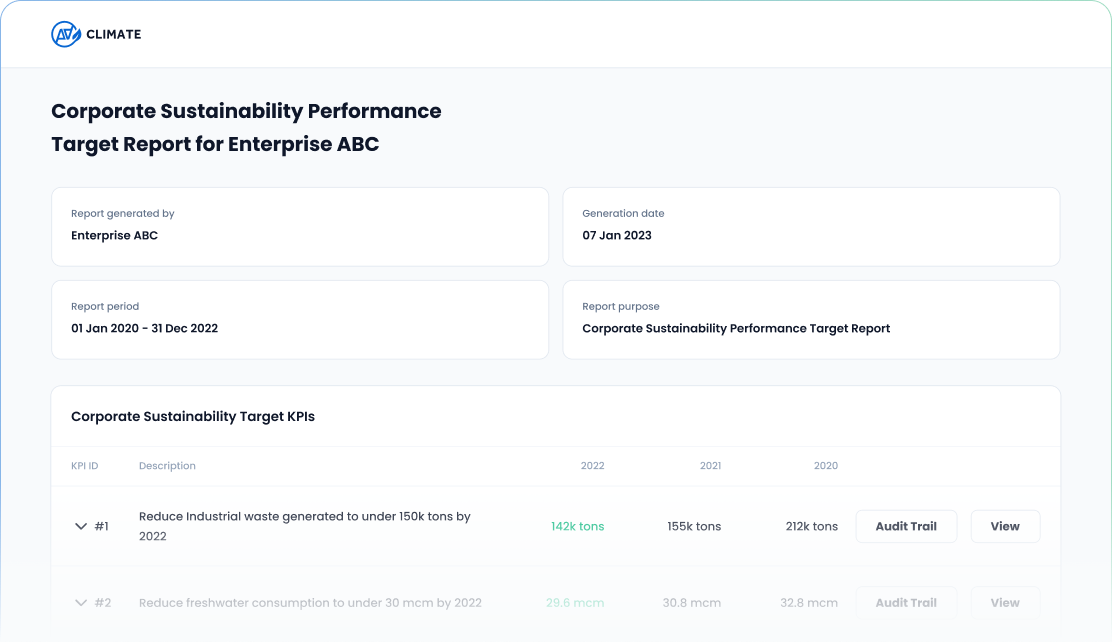

This Allinfra Climate functionality is designed for financial institutions, corporates and investors. It is a highly customised, granular and secured reporting system for the performance monitoring of assets, projects or entities financed with green or sustainability-linked bonds and loans.

Why use it?

The tool provides issuers with a low cost, highly reliable and efficient method to deliver investors and other stakeholders a transparent, timely source of ESG and asset performance information.

Benefits of the Green Finance Impact Reporting Tool

Highly reliable

A single source of truth for reporting on green finance KPIs, accessible by stakeholders.

Transparency

Provides verifiable audit trails on data sourced and how KPIs are calculated.

Adaptable system

Full flexibility and customisation of formulas and KPIs.

User-friendly

Automated, on-demand report generation, easy-to-use interface and simple implementation.

Lower costs

A cost-effective solution encompassing all aspects of KPI definition, data collection, verification and reporting.

Efficiency

Reduces the need for multiple platforms, messy and untimely data exchange, and eliminates complex audit trails.

Get started with the Green Finance Impact Reporting Tool

Are you a green bond issuer looking for a more efficient method to deliver investors and other stakeholders a transparent, timely source of ESG and asset performance information? We can help.